In spite of everything, amongst the requirements for acquiring authorized for just a loan is providing employment and cash flow facts. Fortunately, there are numerous household loans for seniors out there.

That means you could very likely buy a dwelling or refinance depending on Social Stability Advantages, providing you’re at present obtaining them. Validate your private home getting eligibility. Commence right here

Select a repayment expression. Own loans ordinarily have repayment terms from two to seven yrs. A loan by using a long term has lower monthly payments, even though a shorter-expression loan prices much less in interest. Seek out a repayment term that balances reasonably priced payments and lower interest expenses.

Pitfalls and charges: It’s vital to remember that reverse home loans can diminish your private home fairness after a while, perhaps leaving fewer on your heirs.

Some thoughts asked upfront can help you locate a highly skilled lender to system your software and get you the ideal deal. Time to help make a go? Let's locate the appropriate house loan to suit your needs

Obtaining the most beneficial home finance loan for seniors will come all the way down to cautiously balancing their month-to-month cash flow from their every month personal debt to ensure economical stability and peace of mind website in retirement.

Cost savings account guideBest financial savings accountsBest superior-yield price savings accountsSavings accounts alternativesSavings calculator

To get accredited for a home loan, it’s frequently superior to intend to come up with a down payment of not less than twenty% of the home’s value—This is able to develop an LTV of 80% or much less. In case your LTV exceeds eighty%, your loan is probably not permitted, otherwise you may have to buy home finance loan insurance policies in order to get approved.

Homeownership guideManaging a mortgageRefinancing and equityHome improvementHome valueHome insurance

But some HELOCs are. Or, if the time period of your HELOC is nearly up, your lender may well pick out not to extend it. If you have a balloon mortgage loan, you could have hassle refinancing your balloon payment at the conclusion of your loan.

This could certainly liberate cost savings for other takes advantage of, depending on how much time the loan is going to be about. Necessities which include food items, transportation, and prolonged-term treatment are amongst the very best expenses for seniors.

Full desire payments: Investigating the total desire compensated by itself lets you compare the price of just one loan to another. You can also use it as a intestine-Examine to come to a decision In case the loan is worthwhile.

If any of the above applies to you, it might be worth it to consider funding a home in retirement.

It’s also well worth noting that every one FHA loans call for borrowers to purchase mortgage loan insurance coverage as Element of the loan software, so borrowers don’t save any income by generating larger down payments.

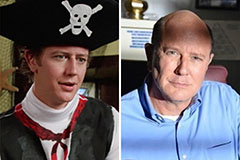

Daniel Stern Then & Now!

Daniel Stern Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!